Schools and Teachers

Welcome to the Centsables Financial Literacy Program

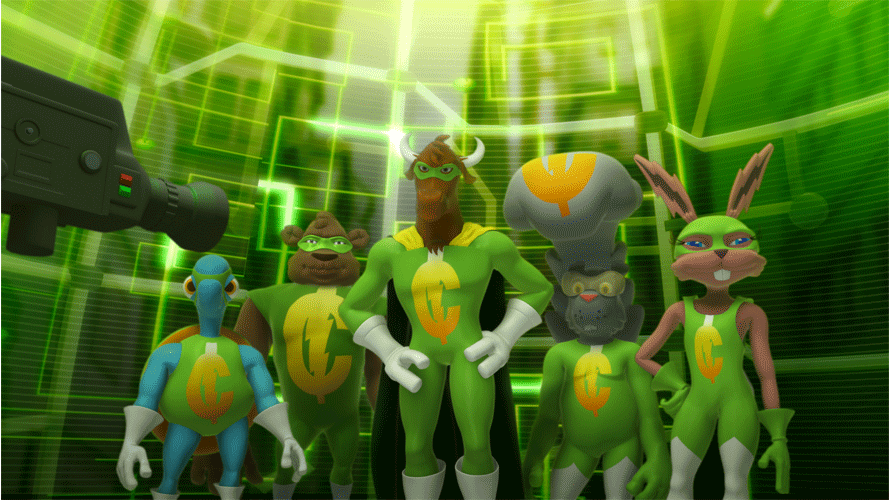

The Centsables is an award-winning initiative with a mission to teach children and teens the fundamentals of financial literacy. We use a multimedia approach to reach students through ‘edu-tainment,’ with animated TV adventures and a related comic book series designed to deepen youngsters’ engagement with the Centsables superheroes while reinforcing financial and prosocial habits.

Teachers and home-schooling parents will find everything they need to present practical, engaging lessons that fit smoothly into a busy school day. A comprehensive library of lesson plans reflects guidelines and national standards for personal finance education. Subject matter is broken into Elementary, Middle and Secondary levels, and many lessons are available on multiple levels. All content is reviewed by an educational consultant, who is part of the Centsables team.

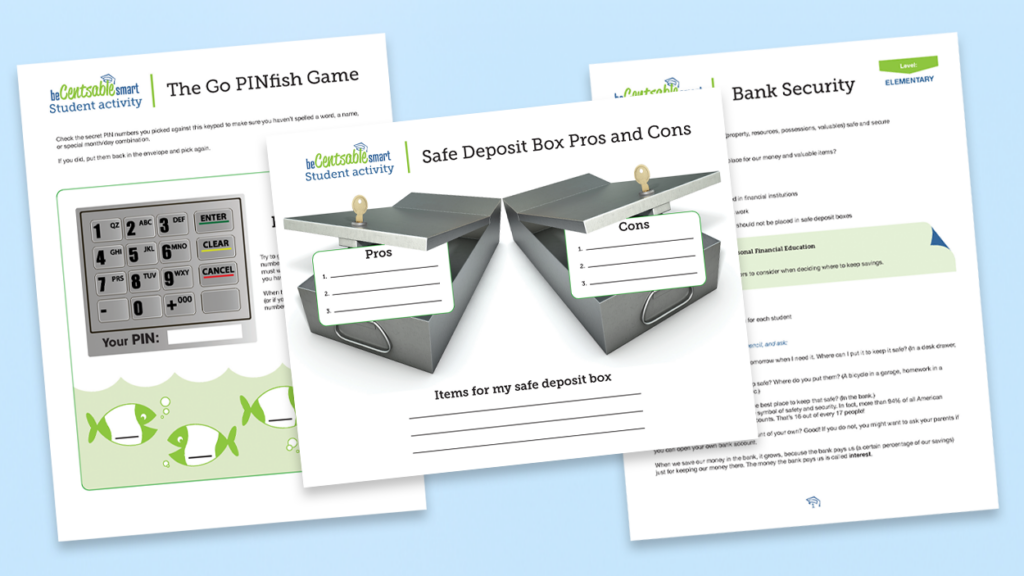

Every lesson includes a step-by-step presentation, plus supplementary materials such as student activity sheets, answer keys, and display items. All components are ready for download.

Classroom Materials

The Centsables program offers a variety of materials for use in schools. There are two libraries of classroom lesson plans – one for primary school students, and one for middle and secondary level students. Each lesson includes all teaching materials, classroom display items, as well as student handouts, and activities.

Primary level lesson plans also come with factivity workbooks, plus bonus ‘edu-tainment’ content which includes our animated episodes (with a financial literacy-based quiz kids segment), and corresponding comic book.

Teachers can conduct classroom lessons according to our detailed step-by-step plans, and then offer students selfguided lessons via our factivity books.

As a program enhancement, teachers can show animated TV episodes during recess or at the end of class. They can also distribute comic books for reading during these times or as a take-home bonus item.

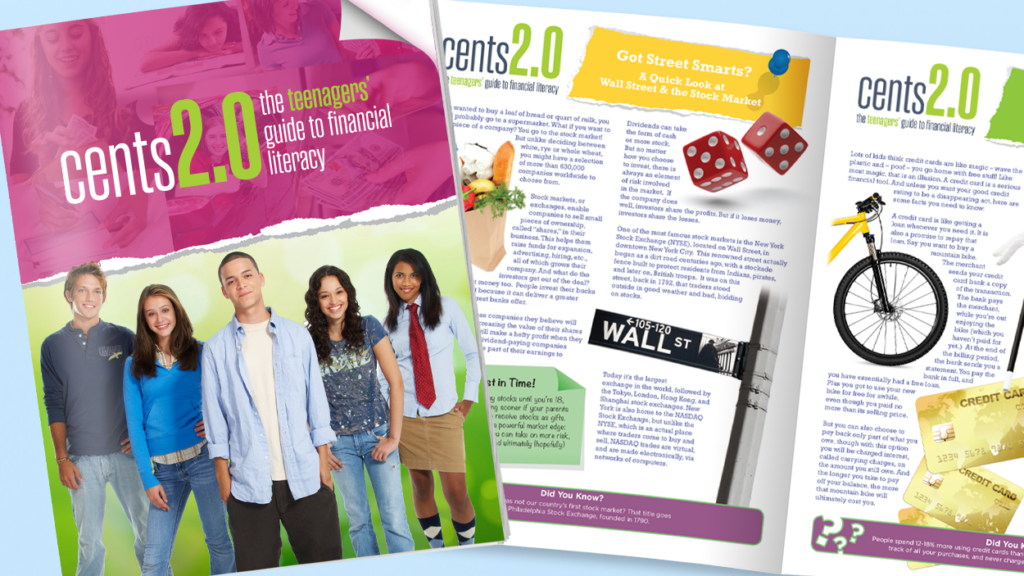

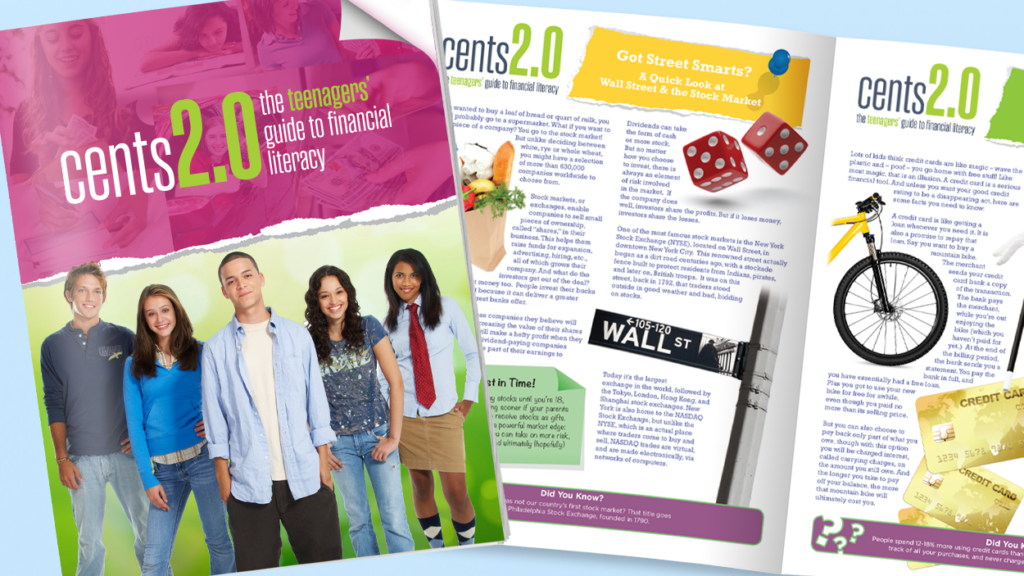

Middle and secondary classroom materials include a library of lesson plans, and our Teenager’s Guide to Financial Literacy. Leveraging this age group’s love of social media, the program also incudes a robust series of lively minivideos delivering financial lessons of special interest to preteens and teens.

Primary Level Material

Primary Level

Lesson Plans

- Identifying coins

- Earning money

- ATMs

- Writing checks

- Identity theft

- What is credit

- Anti-counterfeiting

- Bank security

- Bullying

- Budget

- Charity

- Compound interest

- Wants vs needs

- Exchange rates

- Personal values

- Supply and demand

- Barter vs Money

Primary Level

Factivity Books

VOLUME 1:

• A history of money

• Ways kids can earn money

• Earning interest

• Anti-counterfeit elements in currency

• Supply and demand

• Wants vs needs

• Checking accounts

VOLUME 2:

• A close look at the one dollar bill

• The ABCs of ATMs

• CDs

• Inflation and recession

• Loans

• Using credit cards

• Compound interest

• Sharing assets – treasure, time, and talent

VOLUME 3:

• Understanding bank forms

• The penny – America’s favorite coin

• Debit cards

• Be a junior investing-ator: Intro to the stock market

• Be a junior investing-ator: Bull and Bear markets

• Be a junior investing-ator: Read a stock table

• Be a junior investing-ator: Mutual funds

• Be a junior investing-ator: Buying stock

VOLUME 4:

• Debt

• The FDIC

• The US Mint

• What happens to worn out currency?

• The Bureau of Printing and Engraving

• Mortgages

• Identity theft

• The Federal Reserve

Primary Level

Animated Series & Comic Books

Each Centsables animated episode and corresponding comic book is meant to entertain and spark young viewers’ interest in the financial and prosocial concepts on which each story is based.

All episodes include Quiz Kids segments hosted by the Centsables characters.

Primary Level

Lesson Plans

- Identifying coins

- Earning money

- ATMs

- Writing checks

- Identity theft

- What is credit

- Anti-counterfeiting

- Bank security

- Bullying

- Budget

- Charity

- Compound interest

- Wants vs needs

- Exchange rates

- Personal values

- Supply and demand

- Barter vs Money

Primary Level

Factivity Books

VOLUME 1:

• A history of money

• Ways kids can earn money

• Earning interest

• Anti-counterfeit elements in currency

• Supply and demand

• Wants vs needs

• Checking accounts

VOLUME 2:

• A close look at the one dollar bill

• The ABCs of ATMs

• CDs

• Inflation and recession

• Loans

• Using credit cards

• Compound interest

• Sharing assets – treasure, time, and talent

VOLUME 3:

• Understanding bank forms

• The penny – America’s favorite coin

• Debit cards

• Be a junior investing-ator: Intro to the stock market

• Be a junior investing-ator: Bull and Bear markets

• Be a junior investing-ator: Read a stock table

• Be a junior investing-ator: Mutual funds

• Be a junior investing-ator: Buying stock

VOLUME 4:

• Debt

• The FDIC

• The US Mint

• What happens to worn out currency?

• The Bureau of Printing and Engraving

• Mortgages

• Identity theft

• The Federal Reserve

Primary Level

Animated Series & Comic Books

Each Centsables animated episode and corresponding comic book is meant to entertain and spark young viewers’ interest in the financial and prosocial concepts on which each story is based.

All episodes include Quiz Kids segments hosted by the Centsables characters.

Middle & Secondary Level Material

Middle & Secondary Level

Lesson Plans

Step-by-step plans take a deeper look into financial lessons older students need to learn. The program includes teacher supplementary materials, classroom display items, plus student handouts.

Subjects are:

- Check-writing

- Compound interest

- Budget

- Credit cards

- Identity theft

- Cashless purchases – debit and ATM cards

- Types of savings accounts

- Building a credit history

- Loans

- Financial aid

- Investing

- Insurance

- Financial planning for college

- Supply and demand

Middle & Secondary Level

Mini-Video Topics

Topics include:

MANAGING MONEY:

• Saving for the long term

• Interest

• Types of savings accounts

• Types of checking accounts

• Keeping track of spending

EDUCATION:

• The benefits of higher education

• Saving for college

• Costs of higher education

• Stretching your college budget

• Tuition-free options

• Junior year and the first steps toward college

• ‘Non-college’ education and training options

CREDIT, DEBIT & ATM CARDS:

• Introduction to cashless purchases

• Keeping track of what you owe

• Minimum payments

• Avoiding late fees

• Credit score

• Credit mistakes to avoid

• Advantages and disadvantages of credit

• ATM, debit and prepaid cards

INSURANCE:

• Introduction to insurance

• Auto insurance

• Tips on how to get a lower rate

• Life insurance

• Health insurance

• Homeowner’s insurance

• Disability insurance

INVESTING:

• Introduction to the stock market

• Buying and selling

• Raising capital

• Other forms of investing

• How an investment grows

• Other ways to invest

• Risk and return

• ROI formula

• Custodial accounts

LOANS:

• The business of borrowing

• Financial aid, scholarships, and grants

• Student and Federal loans

• Private loans

• Car loans

• Increase your chances of getting approved

• Leasing vs. buying: pros and cons

Middle & Secondary Level

Lesson Plans

Step-by-step plans take a deeper look into financial lessons older students need to learn. The program includes teacher supplementary materials, classroom display items, plus student handouts.

Subjects are:

- Check-writing

- Compound interest

- Budget

- Credit cards

- Identity theft

- Cashless purchases – debit and ATM cards

- Types of savings accounts

- Building a credit history

- Loans

- Financial aid

- Investing

- Insurance

- Financial planning for college

- Supply and demand

Middle & Secondary Level

Mini-Video Topics

Topics include:

MANAGING MONEY:

• Saving for the long term

• Interest

• Types of savings accounts

• Types of checking accounts

• Keeping track of spending

EDUCATION:

• The benefits of higher education

• Saving for college

• Costs of higher education

• Stretching your college budget

• Tuition-free options

• Junior year and the first steps toward college

• ‘Non-college’ education and training options

CREDIT, DEBIT & ATM CARDS:

• Introduction to cashless purchases

• Keeping track of what you owe

• Minimum payments

• Avoiding late fees

• Credit score

• Credit mistakes to avoid

• Advantages and disadvantages of credit

• ATM, debit and prepaid cards

INSURANCE:

• Introduction to insurance

• Auto insurance

• Tips on how to get a lower rate

• Life insurance

• Health insurance

• Homeowner’s insurance

• Disability insurance

INVESTING:

• Introduction to the stock market

• Buying and selling

• Raising capital

• Other forms of investing

• How an investment grows

• Other ways to invest

• Risk and return

• ROI formula

• Custodial accounts

LOANS:

• The business of borrowing

• Financial aid, scholarships, and grants

• Student and Federal loans

• Private loans

• Car loans

• Increase your chances of getting approved

• Leasing vs. buying: pros and cons

Want to know more? Ask Us anything

We’re here to help at every step, ensuring that you get the most out of the program and its materials. Contact us at any time with questions or special requests.

For more information, questions, or customization requests, please contact:

Samantha Noah

Program Coordinator

Samantha@Centsables.com

631 547-6200 ext. 328